If you’re looking to introduce a cost-effective benefit that improves employee retention through reduced employee turnover and supports employees’ financial wellness, look no further than Earned Wage Access (EWA).

Estimated employer savings

$Disclaimer: Calculations based on assumptions and annualised averages

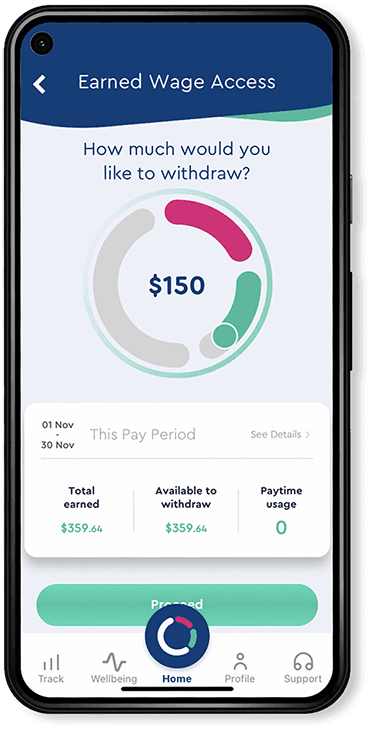

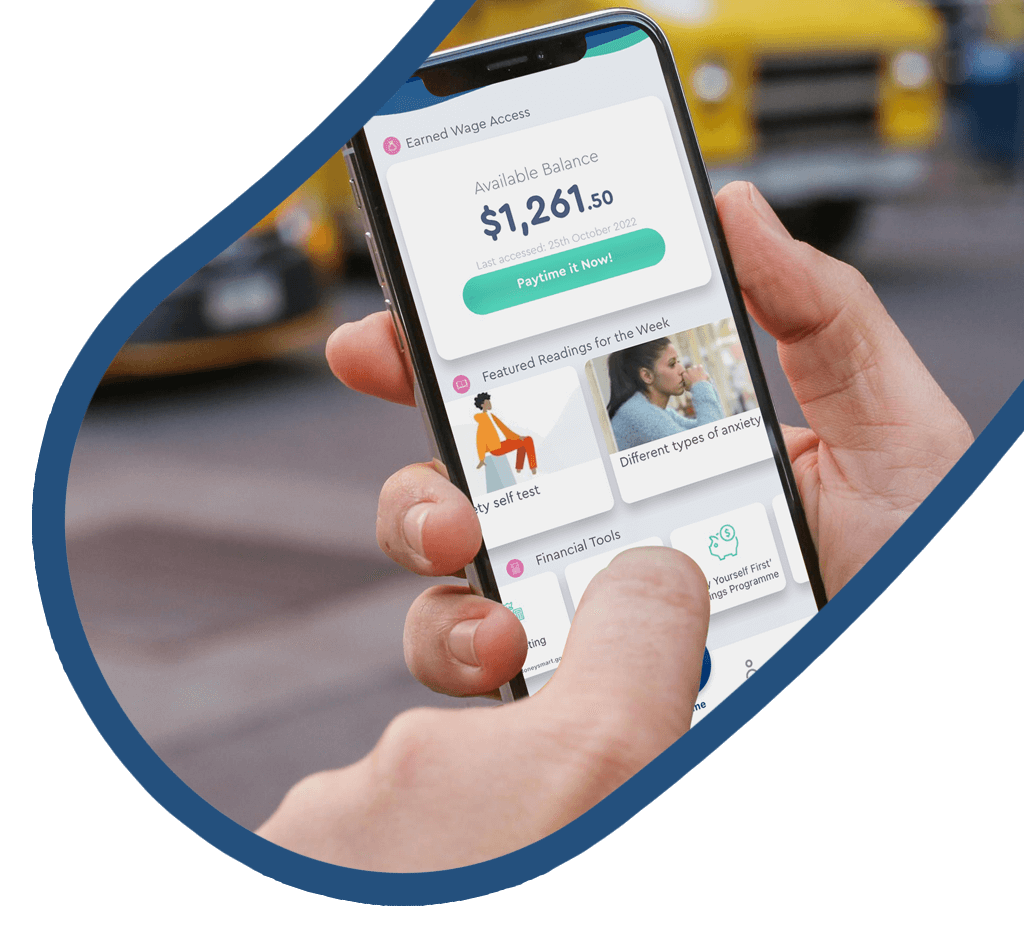

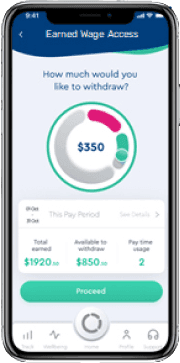

Real-time tracking of earnings, provide instant access to earned wages.

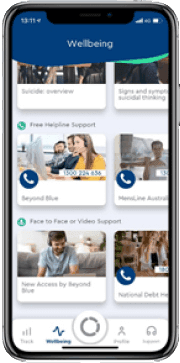

Resources, initiatives and helplines on financial and mental wellbeing.

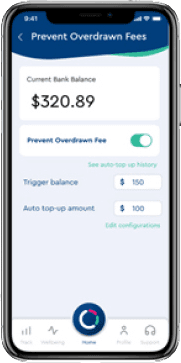

Various tools to reach their budgeting goals and avoid unnecessary loans.

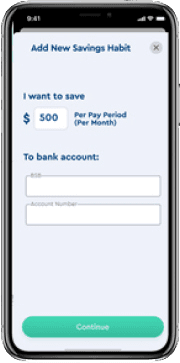

Easy ‘set-and-forget’ savings programs.

5

0

%

3

3

%

7

0

%

2

0

%

2

5

%

1

5

%

When an employee takes money out of their earned pay, Paytime does all the hard work; sending the money to the employee (using our own funds, so there is no impact on your cashflow) and automatically logging the withdrawal & fees in your payroll system.

When payday comes, your employees receive their wages with any withdrawals and fees shown as deductions. So all you have to do is simply run payroll as you usually would and we’ll take care of the rest.