Ever been in a situation where unexpected expenses pop up that throws off your cash flow, or you realize you under budgeted your expenses for the month? Industry research indicates 50% of Australians live pay-check to pay-check, therefore, when an unexpected bill pops up that has not been budgeted for, many Austraians find themselves in a difficult situation where they need a quick and simple cash advance.

This is where salary advances come into play, and to many unsuspecting employees, seem like the best option of all short term loans. Before Paytime analyzes the primary advantages and disadvantages of a salary advance, let’s take a moment to define the wage advance, or pay advance service.

A salary advance is also commonly referred to as a payday loan, pay-on-demand service, or wage advance service. These pay advance apps offer short-term, personal loans that provide you with a cash advance whilst you are waiting for payday. Put simply, for a fee, a pay advance service will lend you money in anticipation of your next pay day. Fast tracking your next paycheck.

The requirements of using these services? There are a couple you should be aware of. Firstly, there’s a cash advance limit, based on your pay cycle. Meaning, you can only pull out a certain amount per each pay cycle. Secondly, there’s a fee every time you make a cash advance, it’s usually 5% but this will depend on the service provider. Be sure to check the terms and conditions before signing the dotted line!

Lastly, the money is almost immediately put into your bank account, however, it is usually automatically deducted from your next paycheck unless you request to spread your repayments over multiple pay cycles (which usually incurs paying interest).

Convenience

It is well known that it can be difficult to borrow money directly from a bank due to their due diligence and compliance regulations. Additionally, banks are more inclined to lend you a sum of money in the thousands rather than in the hundreds.

Undertaking a salary advance through wage advance services is viewed as a much more convenient route with simple procedures, flexible amount withdrawal, and transparent fees and interest rates. You can also request a small amount, such as $100, and these providers don’t require credit checks. More often than not, the loan amount is automatically deducted from your next pay-slip, which ignites a set-and-forget kind of mentality. Meaning, you have the money in your bank account now, and the debt will automatically resolve itself. This constructs the perspective that you don’t need to save up money to pay back the short-term, personal loan.

Unpredicted Expenses

Most things in life are unpredictable, including expenses due to accidents, health issues, or machinery malfunction. Although ‘unpredicted expenses’ has negative connotations, there can be positive unexpected expenses too – like getting engaged! Nonetheless, good or bad, an unexpected bill is an unexpected bill. In these situations, instead of dipping into long term savings or finding the energy to negotiate with a bank, it is commonly seen as the better approach to take a simple cash advance. Start with the small amount you believe will get you by until your next paycheck, and you can easily pull out another advance if you find your calculations to be slightly off.

Many Australians in the workforce believe salary advance services were created simply to benefit the workforce – purely as a way to assist the financial situation of employees. However, like any business, a business’ overarching goal is to make money.

Due to the false, positive stigma associated with salary advances, many individuals overlook the underlying fact that a cash advance is still a loan. Regardless of the loan term or loan amount, a loan is a loan. Simple. Unfortunately, by overlooking this foundational fact, many individuals become swept away with taking cash advances whenever a slight inconvenience occurs… not realizing that the more they borrow this month, the less they have to spend next month as a salary advance is (usually) automatically deducted from the next pay.

As a result, the individual will have to take another wage advance, pay another fee (or interest rate), and continue this vicious cycle. A few months of this process causes a debt spiral. Soon after, in order to cut off the salary advances for good (given their high fees and interest rates), many individuals will see a credit card as the solution… causing more debt.

When dealing with loans of any kind, it’s important to remember your income doesn’t change – so when you spend more than you make, you’re living outside of your means and will need to sacrifice somewhere in order to get back to living within your means.

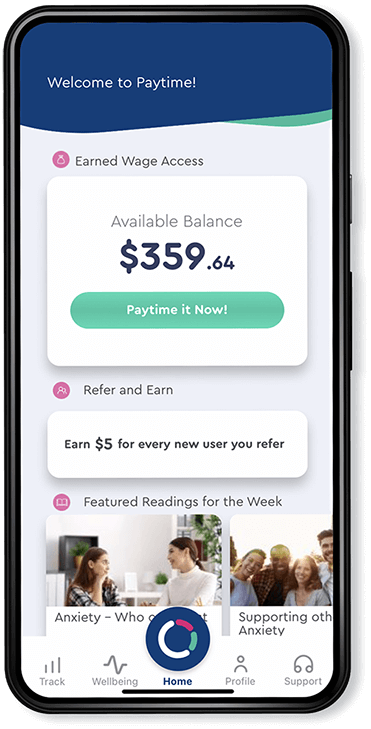

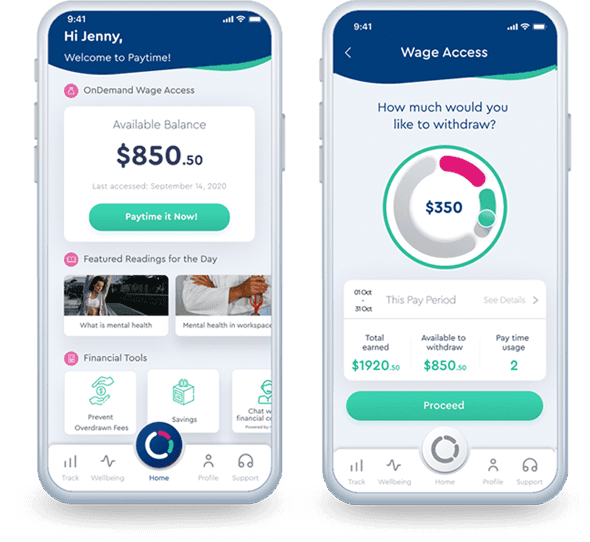

You’ll be pleased to know there is an alternative to short-term loans – Earned Wage Access (EWA). This service is free for employees and for employers. For employers, Paytime’s service seamlessly integrates with your existing payroll – eliminating cost and difficulty of set up.

How does EWA work? Well, instead of providing you with a cash advancement, EWA provides you with early access to your earned wages. After you’ve worked an 8 hour day, you will have access to the wage you will receive for having worked those 8 hours.

This alternative on-demand pay service encourages a fruitful cash flow and eliminates any chances of employees falling into a debt cycle as they have continuous access to income. Instead of living pay-check to pay-check, individuals are able to better budget their upcoming expenses, respond appropriately to unpredicted expenses, and live a healthier lifestyle due to reduced financial stress.

It’s no surprise this method of cash flow enhancement is becoming increasingly popular and making its way into many employee benefit programs.