Trusted By

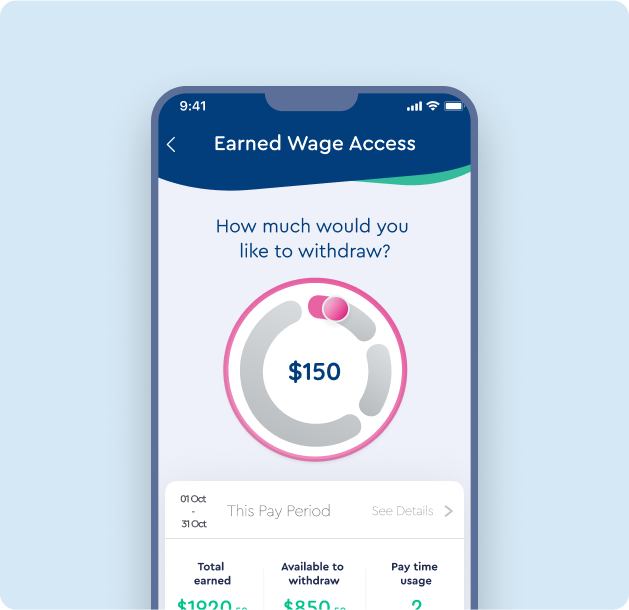

Give your team Earned Wage Access (EWA) – the ability to access wages they’ve already earned before payday. Not a loan, just their money when they need it. Show your team you’re different with a benefit that actually helps with real life.

Real example:

Tom is paid weekly on Wednesdays, his child falls ill on Saturday and he buys medication.

His electricity is due Monday and is short on money.

Without Paytime he would need to turn to a payday loan or credit, starting a debt spiral.

With Paytime he accessed a portion of his already earned wages on the Monday to pay the electricity & gets his remaining pay on Wednesday, avoiding debt.

The business wins too as Tom is loyal and invariably puts in more shifts without the financial stress

Your industry doesn’t match traditional pay cycles.

Split shifts today, rent due tomorrow. Weekend penalties earned Saturday, bills due Monday. Your team navigates complex income patterns while expenses hit constantly.

The business win: Offer flexibility competitors can’t match. Staff stay for the benefit, not just wages.

Zero cashflow impact – Paytime covers all advances until payday.

Actually, the opposite. International data shows 90% of users avoid expensive payday loans once they have EWA. Most common uses? Groceries (24%) and bills (22%). Not impulse buys.

“Paytime added no extra work for our team, it’s a simple process” – Stephanie Mackey, Payroll Officer, Supabarn.

Financial stress costs Australian businesses $30.9B annually in lost productivity. It’s the leading cause of mental health issues. Plus, 67% of your team will actually use this – unlike that dusty gym discount.

In hospitality, keeping good staff is everything. While you can’t always compete on base wages, you can offer something better – financial flexibility that actually improves their lives.

of employees stay longer at businesses offering earned wage access.

Your payroll stays exactly the same. We handle everything else