The personal finance industry can be a complicated area for many of us to navigate. It’s not our fault – the industry is continually changing its product offerings, terms and conditions, payment and fee structures. Some do it to offer a superior service, others to pry more money from unsuspecting customers. Therefore, it’s not at all surprising that many Australians don’t truly understand their personal finance options, and instead, rely on what is most advertised or convenient to access and use.

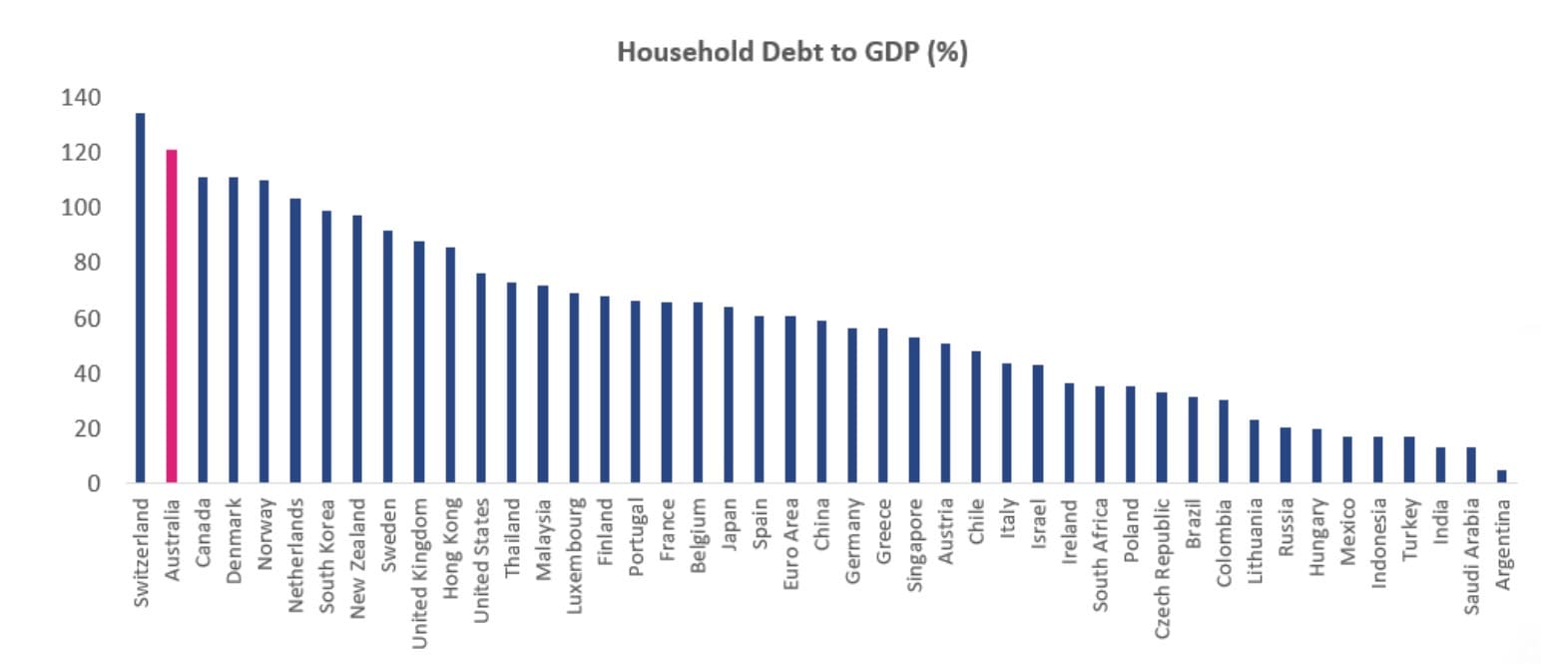

Choosing a responsible, financially healthy option is extremely difficult under these confusing conditions. Worst still, Australians carry the second-highest level of household debt globally.

Source: Niko Asset Management

Source: Niko Asset Management

On top of Mortgage debt, this personal debt spiral is exacerbated by the wide range of easy-to-access short term debt solutions, including bank overdrafts, payday loans, credit cards, Buy Now Pay Later (BNPL) schemes and now Early Wage Access (EWA). To avoid this situation, employees must understand their options and choose solutions that benefit their financial flexibility and wellbeing.

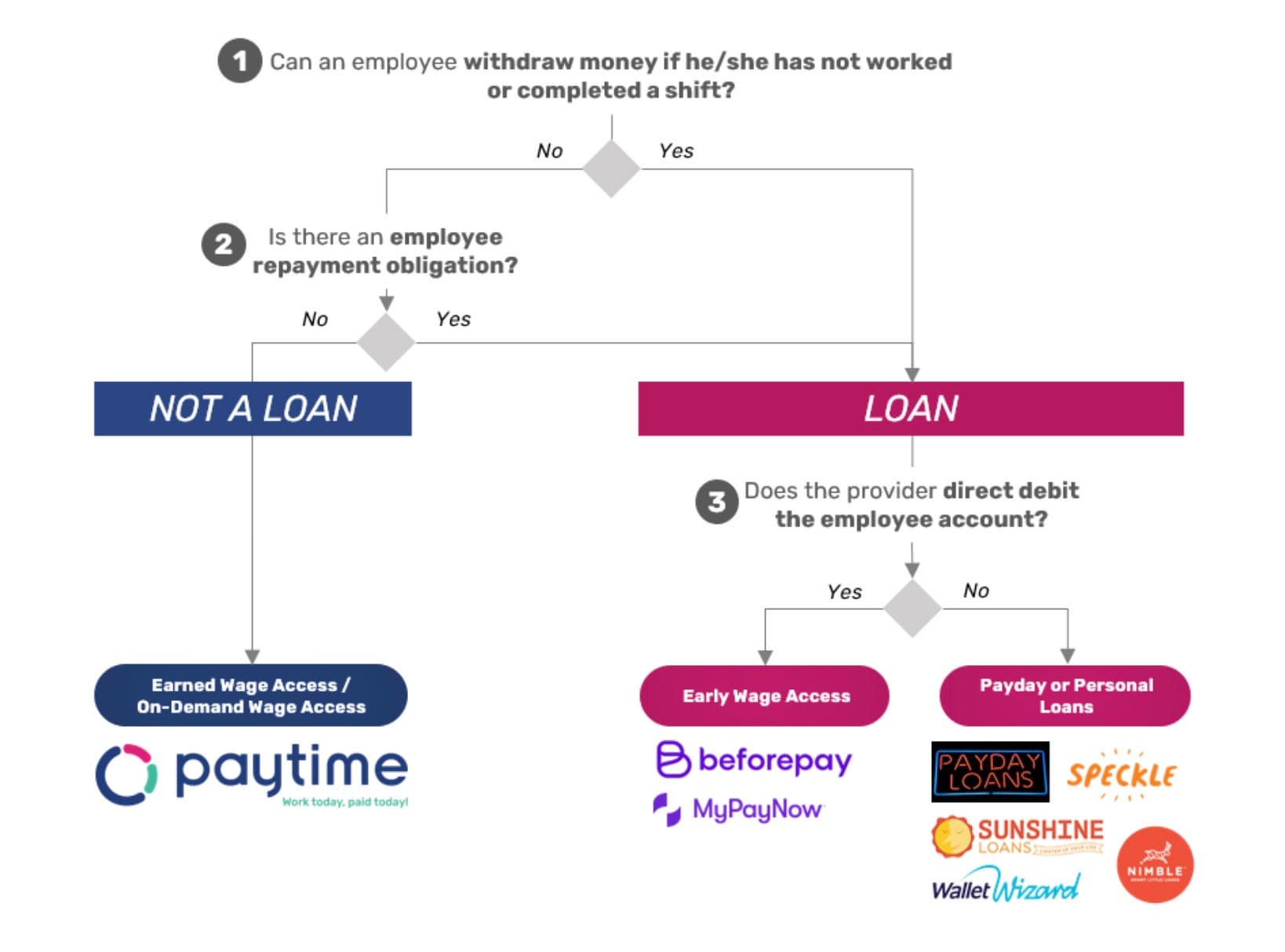

Earned Wage Access (EWA) and Early wage access (EWA) sound very similar on paper, but they are very different in practice. Let’s take a look at what the differences are.

The Differences Between EWA and EWA

By looking solely at their names, Earned Wage Access and Early Wage Acces would appear to be almost the same. In reality, there is a stark and meaningful difference between the two. The main difference is that Early Wage Access is a personal loan/credit (akin to a payday loan but with repayments processed through a direct debit order), whereas Earned Wage Access, or also known as Earned Wage Access, is not.

There are only 3 questions that one needs to ask to understand the differences in characteristics:

Early Wage Access (EWA) is Effectively a Costly Loan Arrangement – What We Would Call “a Cousin to Payday Loans”

EWA schemes are notorious for costing users more than expected, encouraging dangerous debt spirals and often leading to a change in use from the borrower’s intentions. It’s critical to note the primary mechanism of EWA arrangements – they are a loan from an external provider and do not involve the employer.

An employee creates an account with the EWA provider, links their bank account and provides necessary employment information and verification, such as their rate of pay, hours worked, and when they get paid (historically). From this, the provider sets a loan limit, based on what the user has either self-reported as their income, or what the EWA provider can “see” from historical bank statements. Sometimes this income is verified however, a traditional credit check is rarely undertaken. The employee repays the funds as follows – the lender direct debits the employee’s bank account in one or multiple instalments on the (expected) date/s of their next/future paydays.

EWA schemes are expensive, and can become predatory. The new “fintech” solutions that are popping up charge high rates (usually 5% of the withdrawal amount), which is equivalent to an effective annualised interest rate of between 60 – 120% depending on when the funds are drawn relative to the repayment date (i.e. payday). So even if no other charges are applied other than the once off 5% fee (as this would then make EWA a consumer loan under the Consumer Credit Act), EWA is already an expensive option. It should also be noted that if the Employee (or user) does not have enough balance in their bank account on repayment date, an ‘unspecified’ amount of ‘enforcement fees’ will be charged (just like a payday loan, and any other personal credit – although the late and default fees for these will be specified upfront). After all, the employees are the ones who are liable to pay back the advances/loan.

Earned Wage Access (EWA), also Commonly Known as Earned Wage Access, is Not a Loan

In contrast to EWA arrangements, Earned or Earned Wage Access (EWA) is developed for companies to offer their employees an equitable solution to the rigid monthly or fortnightly paydays. The EWA provider integrates with the employer’s payroll system to accurately account for truly earned wages in real-time and makes them available to the employees on-demand. At the end of each work day, the employee can access a convenient mobile app to see how their earned wages are accruing in real time. They may then choose to draw down some of their earned wages at any time, for a small fixed fee, often less than the cost of a cup of coffee. Remember, this is money the employee has already earned – it is theirs!

It’s common for employers to subsidise this fee on behalf of their employees as a component of their employee benefits and financial wellbeing strategy. This reduces, or completely eliminates, the service’s cost, making it a meaningful tool for any employee that would benefit from cash flow flexibility. It should also be noted that the employee is usually only able to withdraw up to 50-60% of their earned/accrued wages at any point in time. This is part of the set of guardrails agreed upon by the employer to ensure that the employee is still paid some funds on payday. When payday arrives, the employee will still receive their usual paycheck, less the amount they’ve already drawn down. It is important to note that the employee is not liable to repay these funds – ever! EWA is not a loan, and interest is never charged.

Earned Wage Access (EWA) Forms the Foundation to Break the Payday Trap while Making Organisations a Better Place to Work

For employees living paycheck to paycheck, EWA provides the foundation they need to break free from the payday trap. When an unexpected expense arises, these employees must find an alternative way to pay. Often this is new debt (incurring fees and interest charges) which is then serviced on their next payday. Earned Wage Access (EWA) allows employees in this situation to access cash when they need it, increasing their cash flow flexibility and reducing their reliance on new debt.

For corporates, EWA is a great tool to establish financial wellness for your employees and reduce financial stress by equipping them with a means to make more informed everyday spending decisions (EWA does not do this). Financial stress is damaging to your workforce; Map My Plan found that employees who are financially stressed may spend up to 10% of their paid working hours consumed by thoughts of financial issues. This results in increased employee turnover and sick days being taken, costing employers over $60 billion every year.

It’s also a huge help when it comes to retaining existing staff and landing new talent. Job seekers are almost two times as likely to accept a 13% lower salary when Earned Wage Access is an option. Employers benefit from increased employee retention, higher engagement and improved competitiveness in the labour market – EWA is truly a win-win!

In contrast, EWA arrangements do little to address the reason why employees are stuck in a paycheck to paycheck cycle. High interest rates and accumulating fees or even the once off 5% fee, may make it very difficult for users to reduce their reliance on their next paycheck. Accumulated debt may lead to additional loans being taken out to cover repayments, as well as damaging the user’s credit score if they are unable to repay it.

It’s clear that although EWA solves the need for short-term cashflow support, it doesn’t address the root cause of it – the payday cycle trap of being paid once or at best twice a month. EWA on the other hand addresses the cause and promotes sustainable benefits for both the employee and the employer. If your company wants to empower your employees and improve their financial wellbeing by enabling flexible on-demand access to their earned wages contact Paytime today to arrange a free consultation.

Implementing Payday Super can enhance employee satisfaction by ensuring superannuation contributions are available when needed most.