If you offer flexible work but not flexible pay, you are only halfway there

Flexibility at work has become a baseline expectation. Yet while hybrid schedules and remote options are now standard, flexibility in how and when employees access their pay has lagged behind. In a cost of living crunch, that gap is costly for both people and business. Employees want more control over cash flow without resorting to high-interest credit. HR leaders and CFOs want lower turnover, higher engagement and fewer payroll headaches.

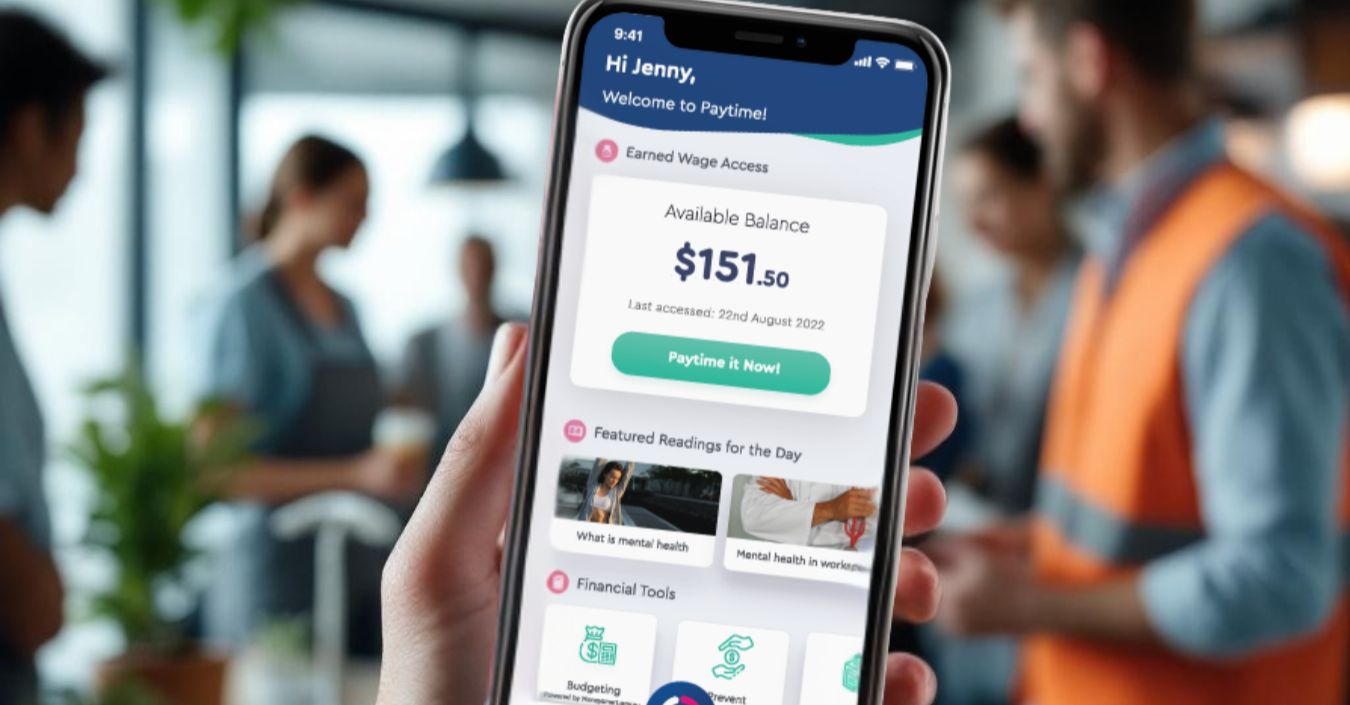

Earned Wage Access bridges that gap. By letting employees access a portion of wages they have already earned, organisations can reduce financial stress, strengthen EVP and improve productivity without changing payroll cycles. In Australia, demand is clear and growing. Companies that move now can set a new standard for employee care and operational efficiency. This edition unpacks the workforce shift, the business case and how to implement EWA responsibly and at scale.

The workforce shift: Flexibility now means more than where you work The last five years rewired expectations. Work-from-anywhere showed people what autonomy feels like, and consumer apps normalised on-demand everything. At the same time, cost pressures have made budgeting harder, with small cash timing gaps turning into big financial stress. For many employees, especially younger cohorts and frontline workers, the question is not just how they work, but how they get paid.

That shift shows up in three ways:

- Changing demographics and expectations: Gen Z and Millennials prioritise flexibility, immediacy and transparency. They expect to see earnings accrue in real time and to access a portion when needed. Flexible work without flexible pay feels inconsistent with how they live and plan.

- Behavioural reality: Financial stress is often about timing, not income alone. An unexpected bill two days before payday can push someone to high-interest credit, creating a debt spiral that lasts months. EWA replaces that cliff with a controlled bridge using wages already earned.

- EVP alignment: Employers have invested heavily in wellbeing, yet money stress remains the top driver of distraction at work. A genuine financial wellbeing strategy needs tools that change outcomes, not just awareness.

The business case: Retention, productivity and measurable ROI Pay flexibility is not a perk on the side. It is a lever for performance and cost control.

- Talent attraction and retention: In tight labour markets, benefits that solve real problems stand out. Evidence shows strong employee appetite for EWA, with the majority saying they would consider switching to an employer that offers it. In our experience at Paytime, Australian organisations see faster time-to-hire and improved retention when EWA is part of the benefits suite.

- Productivity uplift: Financial stress is a silent productivity drain. When employees can resolve short-term cash gaps without shame or admin hurdles, they bring more focus to work. Many report willingness to pick up extra shifts when they can access part of those earnings as they go. Managers also report fewer last-minute calls requesting help before payday.

- Administrative efficiency: HR and payroll teams spend countless hours on ad hoc payroll requests, leave cash-outs and one-off advances. EWA can reduce that noise significantly with zero disruption to existing payroll cycles. A well-implemented solution gives employees a self-serve tool, while finance keeps control through clear limits, governance and reporting.

- Risk and compliance: Done properly, EWA is not a loan. It is access to money already earned, delivered within guardrails. That design avoids the risks of predatory credit and supports a stronger ethical stance on employee care.

Practical application: How HR and CFOs can adopt EWA responsibly EWA works best when it is integrated into a broader financial wellbeing strategy and implemented with clear controls. Here is a proven approach:

1) Design with guardrails

- Set a maximum percentage of accrued wages available to withdraw per pay cycle.

- Define daily or weekly caps to promote responsible use.

- Establish eligibility rules like probation periods or employment status if needed.

- Keep it opt-in and transparent, with zero hidden fees.

2) Integrate, do not overhaul

- Choose a provider that plugs into your existing payroll without changing cycles, awards or processes.

- Ensure the provider funds withdrawals and reconciles automatically on payday to keep cash flow clean.

- Confirm robust data security, privacy and compliance practices.

3) Communicate for adoption and wellbeing

- Launch with clear, empathetic employee communication. Focus on how and when to use EWA wisely.

- Pair access with education. Offer budgeting tools, financial literacy resources and access to financial counsellors for those who want deeper support.

- Train managers to discuss the benefit confidently and to redirect financial requests to the platform instead of ad hoc advances.

4) Measure what matters

- Track uptake and frequency to spot patterns and target education.

- Monitor retention, absenteeism, overtime uptake, employee NPS and payroll admin time saved.

- Review outcomes quarterly and tune guardrails to balance access, usage and wellbeing.

5) Start small, scale with confidence

- Pilot with one business unit or region for 8 to 12 weeks.

- Gather qualitative feedback and quantitative results.

- Expand in phases, maintaining consistent controls and messaging.

With the right design, EWA is a low-friction, high-impact benefit. For HR, it boosts EVP and engagement. For CFOs, it offers measurable returns in retention and admin efficiency, with visibility and control through dashboards and reporting. For employees, it delivers dignity and choice when it matters most.

How is your organisation approaching pay flexibility this year? Explore how EWA can fit your workforce and payroll with zero disruption. Read more or book a free demo.